TOYOTA CITY, Japan – The presence of the Japanese automaker Toyota permeates all aspects of daily life in this city named after it. Locals aim for employment at Toyota, with even their vacations often aligning with the company’s manufacturing calendar. You'll see its moniker everywhere from hospitals and hotels to a local rugby club, museums, and a subway stop.

However, Toyota Motor Corp., which is a significant Japanese employer and holds the title of being the world’s biggest automaker, is currently facing challenges due to the Trump administration’s policies. 25% duties on imported vehicles. Similarly, its namesake city is frequently referred to as the "Detroit of Japan."

I'm concerned," stated Nobuo Ogura, a 60-year-old owner of a sushi restaurant located near one of the dormitories for Toyota plant employees. His primary clientele consists of individuals working for Toyota and related companies. "Should automobile sales decline, it could drag down the local economy as well. Employees in this automotive sector might experience reduced salaries, leading them to cut back on spending.

The automotive sector constitutes nearly 3 percent of Japan’s gross domestic product, as reported by the International Trade Administration. Moreover, the United States stands out as its biggest market, representing about one-third of all Japanese-exported vehicles in the previous year, based on data from the Japan Automobile Manufacturers Association.

This situation feels existential for Ogura, Toyota, and the broader region surrounding Toyota City—home to the company’s headquarters, its 11 plants located in Japan, and numerous suppliers—to President Donald Trump’s tariff policies.

Trump’s tariff blitz Amounting to what Prime Minister Shigeru Ishiba describes as a "national crisis" for export-reliant Japan, he has cautioned about the situation. Despite the general sense of relief across the country this week when Trump stated his position, concerns remain. would lower The blanket tariff on Japanese goods will be reduced from 25 to 10 percent during the trade talks, but the president’s duties on cars stay intact.

Many people living in and running businesses in Toyota City find themselves adopting a wait-and-see approach as they prepare for potential repercussions. A great deal hangs in the balance.

“Toyota contributes greatly to our city’s success,” stated Eri Imai, a jewelry artisan based in Toyota City, whose customer base primarily consists of individuals employed by Toyota and its partner companies.

Toyota will be hit hardest by the tariffs.

In Japan’s industrious region, Toyota City went by the name Koromo up until 1959. It then changed its name to reflect the corporation that spurred its development. During the 1960s and 1970s, car ownership surged dramatically, propelling the country’s economic resurgence following World War II—a period which also significantly boosted the city’s prosperity.

Having ridden the crest of automotive expansion, Toyota City began evolving into a hub for automobiles, co-growing with both the corporation and the sector," stated Mayor Toshihiko Ota of Toyota City, home to approximately 415,000 residents. "From that point onward, our city thrived as an automobile center, and this remains a source of great pride for us.

Several locals remembered the significant supply chain upheavals caused by the coronavirus pandemic and the previous severe job cuts during the 2008 worldwide economic downturn, and they are pondering how these events might affect their community's well-being this time around.

"If the automotive sector, with Toyota at the forefront, faces decline, we will all experience downfall," stated Takeshi Enokizu, who serves as the president of Enoki Kosakusho—a company that primarily provides components specifically designed for Toyota cars.

Trump’s 25 percent tariffs on imported cars went into effect on April 3 and are likely to raise the prices Americans pay for foreign-made cars. This will result in fewer sales for Japanese automakers in their biggest market, auto analysts say.

On May 3rd, the tariffs will also affect automobile components such as engines and transmissions, potentially increasing their cost.

According to a report by Kohei Takahashi from UBS Securities, who specializes as a Japanese automotive industry analyst, the increased tariffs could amount to approximately $25 billion annually (equivalent to 3.6 trillion yen) for Japan’s top five car manufacturers. The study suggests that Toyota might bear up to half of this financial impact.

The sum "will inevitably have an adverse impact on the Japanese economy," stated Takaki Nakanishi, who serves as the lead analyst at the Tokyo-based automotive consulting firm Nakanishi Research Institute.

"The repercussions of America's tariff policy will be immense," Nakanishi stated.

The corporations are currently seeking methods to adapt, but it remains uncertain whether and when consumers might experience an increase in pricing. Although bigger car manufacturers could potentially absorb expenses or identify cost reductions, specialists indicate that their smaller counterparts may lack these alternatives.

"We are closely monitoring the actions of the U.S., particularly regarding tariffs," stated Toyota in an official response to The Washington Post. "We intend to keep focusing on reducing both fixed and various expenses, with plans to sustain our present operations temporarily." However, when asked for further comment from executives, they chose not to participate in interviews.

Honda stated that they are "exploring methods to reduce the impact."

Japan has already moved

Over fifty percent of Japan’s automobiles are manufactured in the U.S., as reported by the Mitsubishi Research Institute, which stems from an automotive conflict in the 1980s.

Japanese firms likewise shifted part of their production to Canada and Mexico, bringing manufacturing nearer to its biggest market and capitalizing on the US-Mexico-Canada Agreement, which was enacted during President Donald Trump’s initial term.

Cars that comply with the tax-exempt conditions of said pact will face duties solely on the parts not originating from the U.S., as stated by the White House. has said.

This implies that Japanese vehicles produced in North America can no longer be considered secure since they might incorporate components manufactured outside of this region and thus fall under the newly imposed tariffs, according to Toshiki Takahashi, who serves as the chief economist at the Institute for International Trade and Investment based in Tokyo.

According to Takahashi, major car manufacturers such as Toyota already have numerous plants in the U.S., which could help them mitigate tariff impacts by boosting their local manufacturing capabilities. As an illustration, Toyota produces its Tacoma pickup trucks in Mexico but uses a significant amount of components sourced from America.

However, the more petite firms possess a lesser proportion of components sourced from America and are poised to experience considerable impact due to the recent tariffs, according to Takahashi.

According to the UBS Securities report, moving production to the United States might not solve the issues faced by Japanese automakers. The study revealed that both labor and factory construction expenses in the U.S. exceed those in Mexico and Japan by over 30 percent.

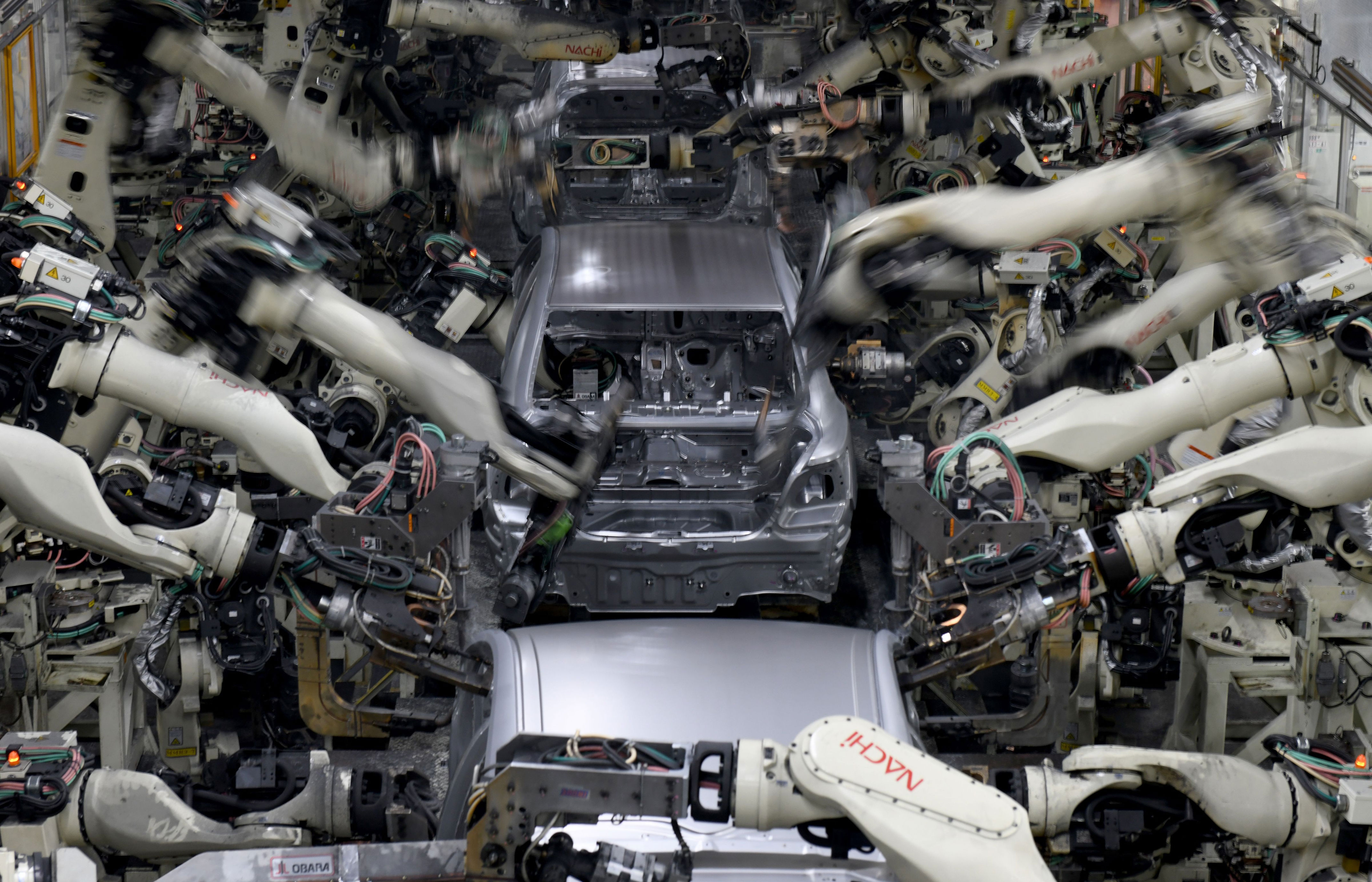

If businesses opted to shift manufacturing, it would still require considerable time. The automotive supply chain is intricate and worldwide, implying that automakers need several years to develop their production strategies, according to Vivek Vaidya, an autos specialist at the consultancy firm Frost & Sullivan based in Singapore.

"It’s not possible for any business to move its supply chain in just a few—forget days, weeks—even over several years. Replacing and recreating an entire supply chain isn’t feasible," Vaidya stated.

Now, Japanese automakers must determine how to stay competitive in their largest market.

Japanese firms have encountered challenges in international markets beyond the U.S., largely due to their major automobile manufacturers placing lesser emphasis on electric vehicles. Meanwhile, hybrid models such as Toyota’s Prius continue to be very successful within the U.S. market. This presents an opportunity for Japan to capitalize on its strengths, according to industry analysts.

"The truth is that nothing else can take the place of the U.S. market," Nakanishi stated.

It remains uncertain how Toyota will react; however, certain analysts indicate that it is better equipped than other Japanese car manufacturers to withstand these challenges due to its substantial scale and financial cushions. This positioning allows it the flexibility to manage additional expenses resulting from the tariffs.

Nevertheless, people living in Toyota City remain unsure about how the tariffs will impact their local economy.

Enokizu, a supplier for Toyota, mentioned that they are attempting not to stress over the repercussions since suppliers have no control over the situation, yet they remain hopeful regarding the discussions.

We're clinging to the hope that a deal can be struck somehow," Enokizu stated. "After all, Trump is fundamentally a businessman.