The Chinese new-energy vehicle (NEV) market—which includes both battery electric vehicles (BEVs) and plug-in hybrid cars—remains robust. Last year, over 11 million NEVs were sold nationwide, marking a rise of 40.7% compared to 2023 figures according to the China Passenger Car Association (CPCA). By the end of Q1 2025, passenger NEV sales in China reached an estimate of approximately 2.86 million units, which represents a 43% increase from the same time frame the previous year as reported by CPCA.

Government support along with increasing customer preference for environmentally friendly vehicles have fueled this growth. However, as competition escalates and a fierce pricing battle continues, the uncertainty lies in identifying which local car manufacturers are more capable of steering through the challenges that lie ahead. NIO Inc. NIO or Li Auto Let's examine both organizations closely based on various crucial factors to determine which one has an advantage presently and, more significantly, which could be the wiser choice for investing right now.

Product Range & Future Releases

Li Auto has established itself with a robust presence due to its extended-range electric vehicles (EREVs), which provide the advantages of electric cars along with greater versatility in terms of driving distance. Its well-received L lineup—comprising models like L6, L7, L8, and L9—has each surpassed sales of 200,000 units. In the previous year, they introduced their inaugural all-battery-electric vehicle (BEV) called the MEGA. Moving forward, Li Auto intends to introduce more BEVs such as the Li i8, i6, i7, and i9 within the coming 12 to 18 months. The debut for the Li i8 is anticipated in July, whereas the release of the i6 is scheduled for some point during the latter part of 2025.

In the meantime, NIO has concentrated solely on producing electric vehicles. The current range offered by NIO consists of the ES6, ET5T, ES8, EC6, ES7, ET5, ET7, EP9, EVE, ET9, and EC7 models. At the end of March 2025, they began delivering their latest offering, the NIO ET9. Earlier, in December 2024, NIO introduced another vehicle called the NIO 89; these units are scheduled to start being delivered towards the close of this month. Additionally, an important new release under the same banner is planned for sometime during the latter part of this year. Apart from the mainline NIO products, the corporation operates two additional labels: ONVO as a mid-range accessible option and Firefly targeting premium compact cars. Their initial item, designated as ONVO L60, was met with positive feedback. Following closely behind, the next product from them—the ONVO L90—is anticipated to roll out sales starting Q3 2025. Moreover, plans include launching yet another unit within ONVO’s portfolio before the calendar turns over into the following year. Meanwhile, Firefly readies itself for the debut of its inaugural design slated for unveiling shortly.

Although NIO provides a wider range of pure electric vehicle options, Li Auto’s shift from extended-range electric vehicles to battery-electric vehicles seems well-timed and has the potential to greatly increase their delivery numbers.

Deliveries

Last year, Li Auto shipped 500,508 vehicles, marking a rise of 33% compared to 2023 figures. Having surpassed half-a-million yearly vehicle shipments in merely five years since their initial delivery, Li established itself as the quickest-rising luxury car marque in China. In the opening three months of 2025, they distributed 92,864 units, aligning with projected expectations and showing an increase of 15.5% year-over-year. By the end of March 2025, Li Auto had cumulatively dispatched 1,226,736 units altogether.

In 2024, NIO shipped 221,970 vehicles, representing a 30.7% rise from the previous year. Despite this achievement, their figure was still under half of what Li Auto managed overall. During the initial three months of 2025, NIO reported delivering 42,094 vehicles—a 40.1% surge compared to the same period last year—and stayed consistent with their forecasted expectations. By the end of March 2025, NIO had cumulatively dispatched 713,658 vehicles since they began. Even though NIO has been accelerating, Li Auto continues to lead significantly in terms of quantity.

Revenue, Profit Margins & Net Income

Li Auto maintains a strong lead in terms of financial success. In 2024, the company reported total revenues of $19.8 billion, marking a 16.6% increase from the previous year, primarily driven by vehicle sales. Additionally, Li Auto posted an operating profit of $961 million and a net income of $1.5 billion last year, solidifying its position as a lucrative electric vehicle manufacturer.

In contrast, NIO reported slightly above $9 billion in revenue for 2024, marking a yearly increase of 18.2%. Vehicle sales made up about 89% of this sum. However, the firm faced an operational deficit of around $3 billion and registered a net loss exceeding $3 billion as well. Despite targeting break-even status by the final quarter of 2025, achieving profitability continues to be difficult.

Let's examine the vehicle profit margins, which are crucial indicators for electric-vehicle firms. In 2024, Li reported a vehicle margin of 19.8%, declining slightly from 21.5% in 2023 yet surpassing NIO’s figure, which stood at 12.3%—an increase from 9.5% recorded in 2023. Nonetheless, they fell short of their objective to reach 15% vehicle margins by year-end 2024. For fiscal year 2025, the firm anticipates an expected vehicle margin of 20% for the NIO brand and 15% for the ONVO brand. Should this projection come true, it would mark significant progress. Currently though, Li Auto maintains higher vehicle margins compared to NIO.

Balance Sheet

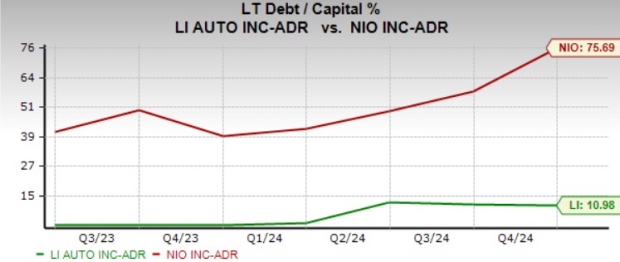

As of December 31, 2024, Li Auto boasts a robust balance sheet featuring approximately $9 billion in cash along with a relatively low long-term debt totaling around $1.1 billion. This fiscal strength enables the company to significantly boost investments in research and development, charging facilities, and international growth efforts without jeopardizing its primary business activities.

Compared to others, NIO possesses only $2.6 billion in cash and bears $1.56 billion in long-term debts. A long-term debt-to-capitalization ratio of 76% highlights its high level of financial leveraging. In this aspect, Li Auto undoubtedly has the advantage.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Retail and Global Expansion

Li Auto keeps expanding at an accelerated pace. By the close of 2024, they will have established 502 retail outlets and 478 service locations throughout China, with over 1,700 fast-charging stations currently available. The company aims to increase this number to 4,000 charging points by the end of 2025. Earlier this year, Li Auto inaugurated its initial international research and development facility in Munich and introduced service centers in Kazakhstan, Dubai, and Uzbekistan.

NIO also boasts an extensive retail footprint, featuring 180 NIO Houses, 603 NIO Spaces, 385 service centers, 67 NIO Delivery Centers worldwide, and 300 ONVO stores as of the close of 2024. The firm aims to expand into 25 nations by the conclusion of 2025.

Technology & Innovation

While both firms are making significant investments in upcoming technologies, they have distinct focal points. One notable advantage for NIO is its battery-swapping technology, which it has successfully rolled out across over 3,200 charging stations globally. Recently, NIO teamed up with CATL to create what will be the biggest and most sophisticated electric vehicle battery-swap infrastructure ever built. This collaboration was highlighted by NIO’s CEO, William Li, as a crucial turning point, emphasizing how this alliance could propel battery swapping towards unprecedented expansion.

In the meantime, Li Auto is advancing significantly in the field of autonomous driving. They have introduced sophisticated driver-assistance systems such as Li AD Max and Pro, designed for both city streets and highways. Leveraging NVIDIA’s robust processors, their technology is progressing rapidly. Importantly, they were the first Chinese carmaker to utilize AI models trained with over ten million video clips, giving them an edge in the competition towards fully automated vehicles. By 2030, LI intends to transform itself into a top-tier AI and robotics firm. The company plans to venture into developing human-like robots; however, this will occur post reaching Level-4 autonomy.

NIO’s investment in battery swapping might yield substantial rewards over time. In contrast, Li Auto’s approach emphasizes practicality and safety in its autonomous technology, providing them with a notable advantage.

Stock Performance and Valuation

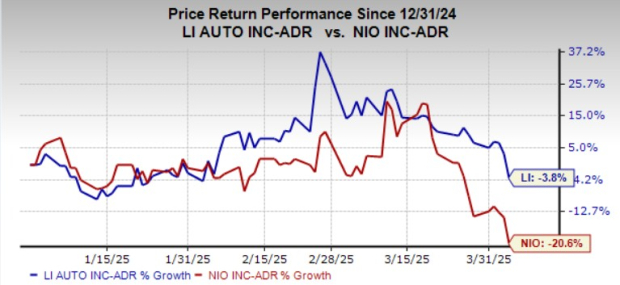

Li Auto has performed better in the market so far this year in 2025.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

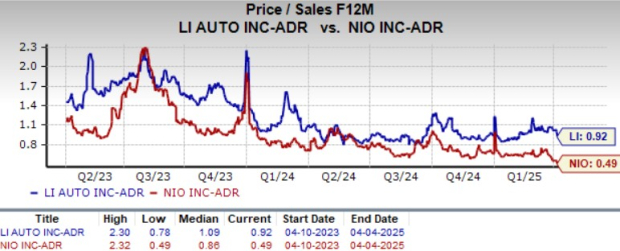

Both LI and NIO shares have lower forward price-to-sales ratios when compared to their respective figures from two years ago. Although NIO might seem less expensive initially, potential buyers ought to look into the fundamental aspects. The profitability of Li Auto along with its leading position in autonomous driving technology could potentially enhance its value. Currently, LI boasts a Value Score of B, whereas NIO holds a Value Score of D.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

How Do Earnings Per Share Estimates Stack Up for LI and NIO?

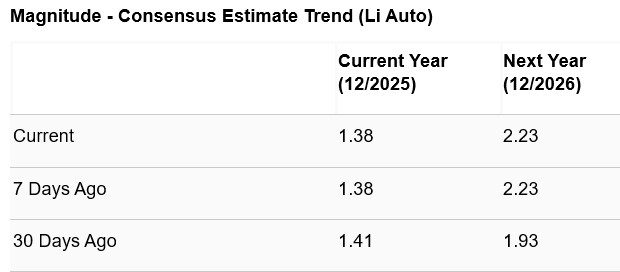

According to the Zacks Consensus Estimate, LI’s earnings per share (EPS) projection for 2025 indicates no anticipated growth; however, the forecast for 2026 predicts a yearly rise of about 61.5%. Over the last month, the prediction for 2025 EPS has declined, contrasting with an upward adjustment seen in the estimates for 2026.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

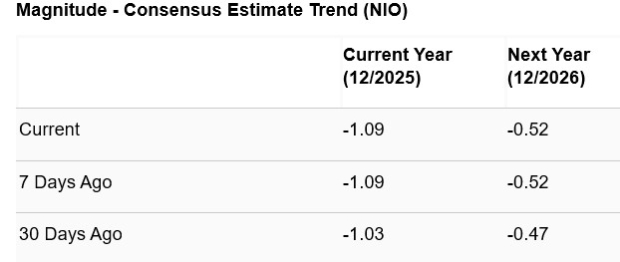

The projected consensus estimate from Zacks for NIO's earnings per share in 2025 and 2026 suggests an annual increase of approximately 28% and 53%, respectively. However, over the last thirty days, the anticipated losses for both 2025 and 2026 have expanded.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Li Auto Offers Superior Safety

Currently, Li Auto leads in various key aspects such as vehicle deliveries, profitability, profit margins, overall financial stability, and autonomous driving technology. However, the company faces some hurdles like aggressive competition leading to price wars and decreasing sales and profits which might impact short-term outcomes. Notably, their projected revenues for Q1 2025 suggest a potential drop compared to last year—their first dip after many quarters. Despite raising concerns, this appears to be a brief setback due to significant market pressures. Nonetheless, with plans shifting towards battery electric vehicles (BEVs) and ongoing investments in artificial intelligence along with international expansion strategies, they seem poised for long-term success.

Although NIO is pioneering with its battery swapping system and brand growth, it still has room for improvement. Significant losses, narrower profit margins, and a highly leveraged financial position make it a more precarious investment option at present.

Among the two, Li Auto appears to be in a more favorable position. Despite facing current short-term pressures and holding a Zacks Rank of #3 (Hold), it still holds a stronger stance compared to NIO, which has a lower rank of #4 (Sell).

You can see Here is the full list of today's Zacks #1 Rank (Strong Buy) stocks. .

The article was initially published on Zacks Investment Research (solusikaki.com).